As we move into the first quarter of 2025, mortgage rates are holding steady after last week’s dip, thanks to a mixed economic outlook and the ongoing uncertainty surrounding tariff policies from the new administration. While we may see volatility in the coming months, there are still reasons to remain optimistic for both homebuyers and sellers.

Why Did Mortgage Rates Dip Slightly?

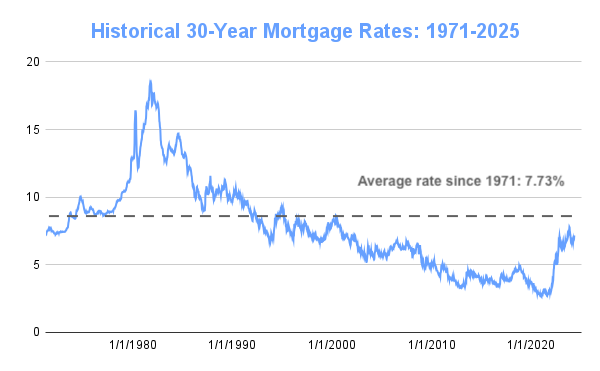

In the lead-up to the presidential inauguration, there were significant concerns that tariffs could increase the cost of goods and services, which could have ripple effects on the economy, including mortgage rates. The Federal Reserve has been actively addressing inflation, and markets have been watching closely to see how sustained inflation could impact future rate cuts. As inflation pressures remain top of mind, the economic environment continues to affect mortgage rates.

However, on January 15, the Consumer Price Index (CPI) report revealed that inflationary pressures had eased more than expected in December, which led to a slight dip in mortgage rates. Despite this, rates are still on the higher side, making it more difficult for many buyers to secure the best deals.

The lack of concrete details regarding tariff policies from the new administration left mortgage rates largely unchanged after the executive orders on January 20. While there’s still a lot of uncertainty in the air, we expect to see fluctuations in mortgage rates as the year progresses, influenced by new economic data and political decisions.

How Does This Impact the Housing Market?

In 2025, we expect to see increased inventory in the housing market, giving buyers more options and potentially more negotiating power. However, higher mortgage rates will still pose a challenge for many homebuyers looking to stay within their budget.

For buyers who may feel priced out of the market, it’s important to keep in mind that renting could lead to even higher costs in the long run, as single-family rents continue to rise due to supply and demand. Even if higher mortgage rates make the market feel out of reach, homeownership remains a powerful financial tool for building long-term wealth.

Why Work With A Real Estate Agent?

While tools like online affordability calculators can give you a snapshot of potential costs, they can’t offer the nuanced guidance of an experienced real estate agent. A professional agent can help you navigate these uncertain times, offering expert advice tailored to your specific situation. They can help you stay ahead of market trends, identify homes that fit within your budget, and even negotiate better terms with sellers.

An agent can also help you get pre-approved with a lender, ensuring that when the right home comes along, you’re ready to act fast—something that’s crucial in a market where inventory is still limited and competition remains high.

Looking Ahead: How to Make the Most of the Current Market

Even with the uncertainties and challenges presented by higher mortgage rates, the housing market still offers plenty of opportunities for motivated buyers and sellers. For potential homebuyers, now is the time to get your financial house in order. Repair any gaps in your credit, get pre-approved for a loan, and consult with a trusted real estate agent to guide you through the process.

There’s no need to wait for rates to drop drastically to make a move—working with an experienced agent can help you secure the best deal possible, even in a more challenging market. The right home, at the right price, could be closer than you think.

Final Thoughts

In today’s market, volatility is inevitable. Mortgage rates may rise and fall, and economic conditions may shift, but homeownership remains one of the most stable and rewarding investments you can make. Don’t let short-term uncertainty keep you from achieving your long-term goals. Whether you’re buying or selling, the right support and expertise can make all the difference.

Leave a comment